When you initially form a business, you have the option of getting an EIN (employer identification number) from the IRS. This is a tax identification number for your business and is required if you have W-2 employees.

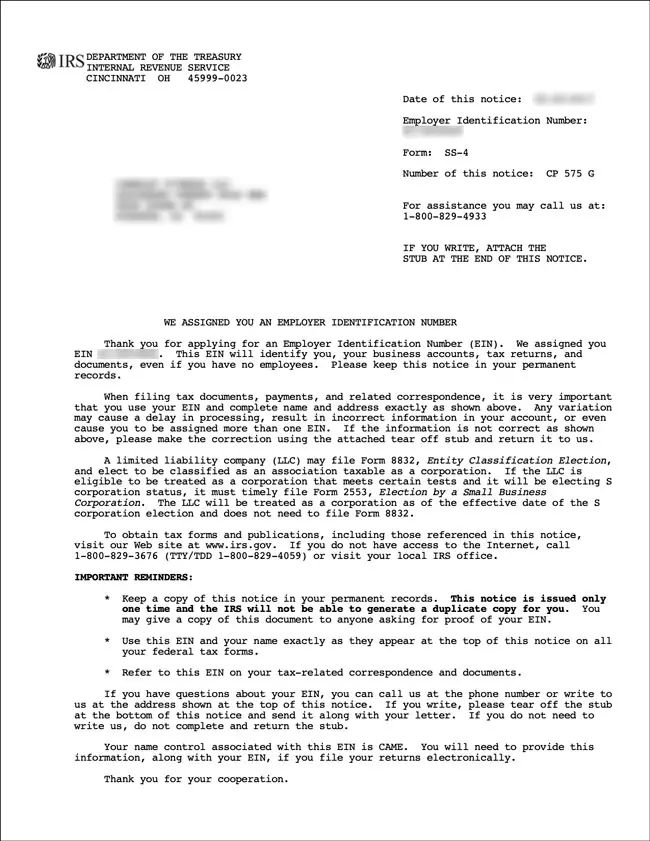

When many people initially get the EIN, the IRS sends out an IRS CP Form 575, which is an EIN confirmation letter. Here is what the letter looks like below:

However, many people do not keep it in a safe place to retrieve later on. That confirmation letter is needed to establish a business bank account, among many other things.

So invariably when you need a certification for your EIN, it is nowhere to be found.

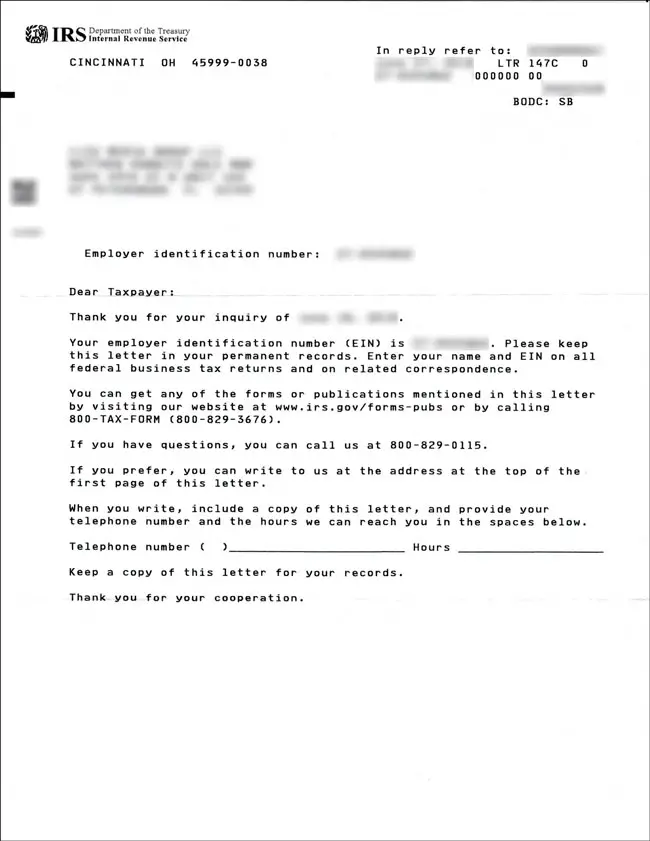

In such instances, you can get an IRS Form 174c, which is an EIN verification letter, which banks will accept to open an account. Here is what it looks like below:

However, if you have ever dealt with a government agency, you will know how cumbersome it is. If you go by snail mail, that verification letter will take weeks to get to you. But there is another way.

In this article, I will show you how to get your EIN verification letter (174c) online instantly, as soon as you are able to get in touch with an IRS customer service rep. With this method, I was able to get my verification letter in 30 minutes, from calling the IRS to getting my letter.

Here are the steps to do so:

Getting Your EIN Verification Letter Online and Instantly

1/ Sign up for Fax Burner.

Fax Burner is a free tax service that allows you to receive faxes. It’s not a free trial where they charge you after 7 days. It is free forever to receive faxes. The only thing is that your fax number is renewed every 24 hours. You can pay to keep that fax number, if you want.

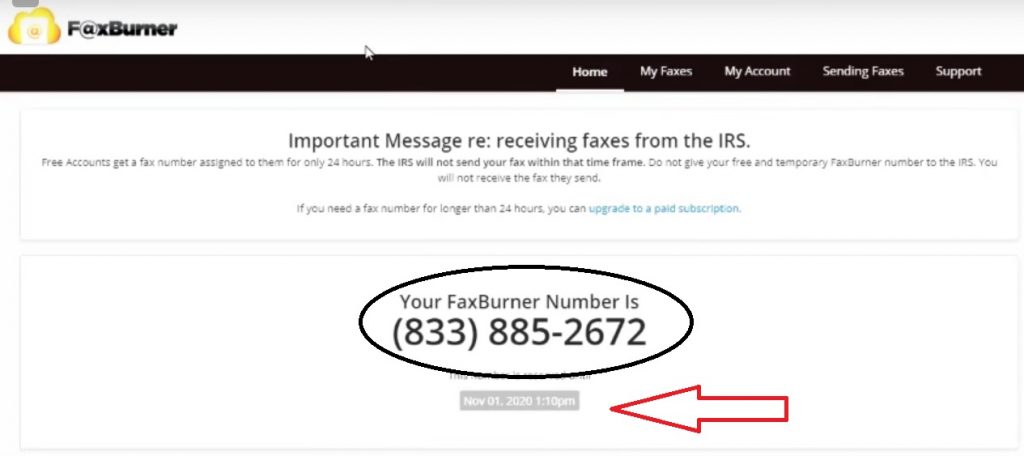

In the picture below, you will see your fax number circled and you will see how long that fax number is yours for by the red arrow.

2/ Call the IRS Business and Specialty Tax line at 1-800-829-4933 between 7:00 AM and 7:00 PM EST. Press 1, 1, and then 3 when presented with the options.

Keep in mind that the IRS is tremendously underfunded and overworked. So if you call during peak hours, you probably won’t get through or be put on wait for hours. So I suggest calling as soon as the lines open.

3/ If you are lucky to reach a customer service representative, she will give you two options. The first option is to receive the letter via snail mail. Like I said, that takes 1-2 weeks. The second option is to receive a fax as they are on the phone with you. Choose that second option and give them your Fax Burner fax number.

4/ Once it is faxed to you, the customer service representative will verify with you that you have received it. Once you received it, download it.

You’re done. That’s it. That’s all you need to do to instantly receive your EIN confirmation number from the IRS.

Caveat

Free Accounts get a fax number assigned to them for only 24 hours. The IRS will not send your fax within that time frame. Do not give your free and temporary FaxBurner number to the IRS. You will not receive the fax they send.

While the warning may be true for most IRS faxes, the people that have tried this method for getting the EIN verification letter have all gotten their faxes instantly.

So what I will say is to make sure the IRS representative is sending the fax to you while they are still on the phone with you, and to make sure that you received the fax prior to hanging up. Otherwise, someone else will get your letter after your 24 hours are up.

If you prefer to watch a video of how to do the above steps, please watch below.